Hail Damage Roof State Farm

To combat this many home insurers have implemented different coverage levels.

Hail damage roof state farm. Wind and hail damage. Meanwhile it keeps raining and blowing and more leaks. According to the national oceanic and atmospheric administration noaa there was a total of 4 611 hail storms in the united states during the year 2018 with 2019 ending on a higher number as of year end more than 5 396 hail events were recorded although most people think that property and roof damage only occur in rare instances with larger than average hailstones even the smallest. I am in the middle of a nightmare with state farm.

Attorney bill voss explores the process of filing a hail damage claim with this popular insurance provider and what you can do if your claim is underpaid. Homeowners filing claims are often confused by the forms inspections and dealing with insurance agents. I have been a loyal customer for 22 years. But when a hail storm or a wind storm smashes the home or the business these insurance companies find ways to make the damage a non covered occurrence.

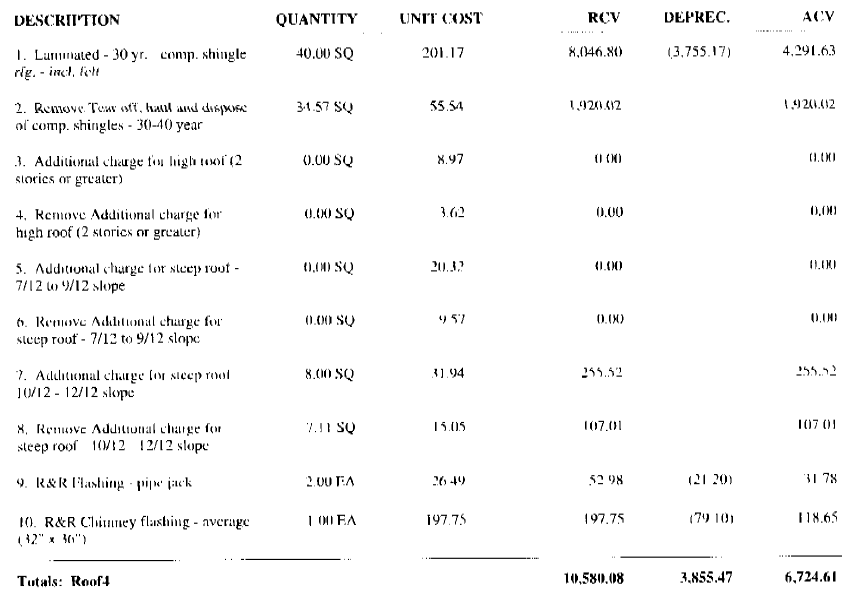

Most homeowners and business owners pay insurance premiums for decades and that money is gleefully and quickly accepted by allstate state farm farm bureau and a hundred other insurers. Take a look at your insurance policy to see what it covers before contacting your insurance company. Th e operation guide provides direction to claims handlers for handling roof claims that involve damage from wind or hail. I have had a contractor tell me i need the whole roof replaced.

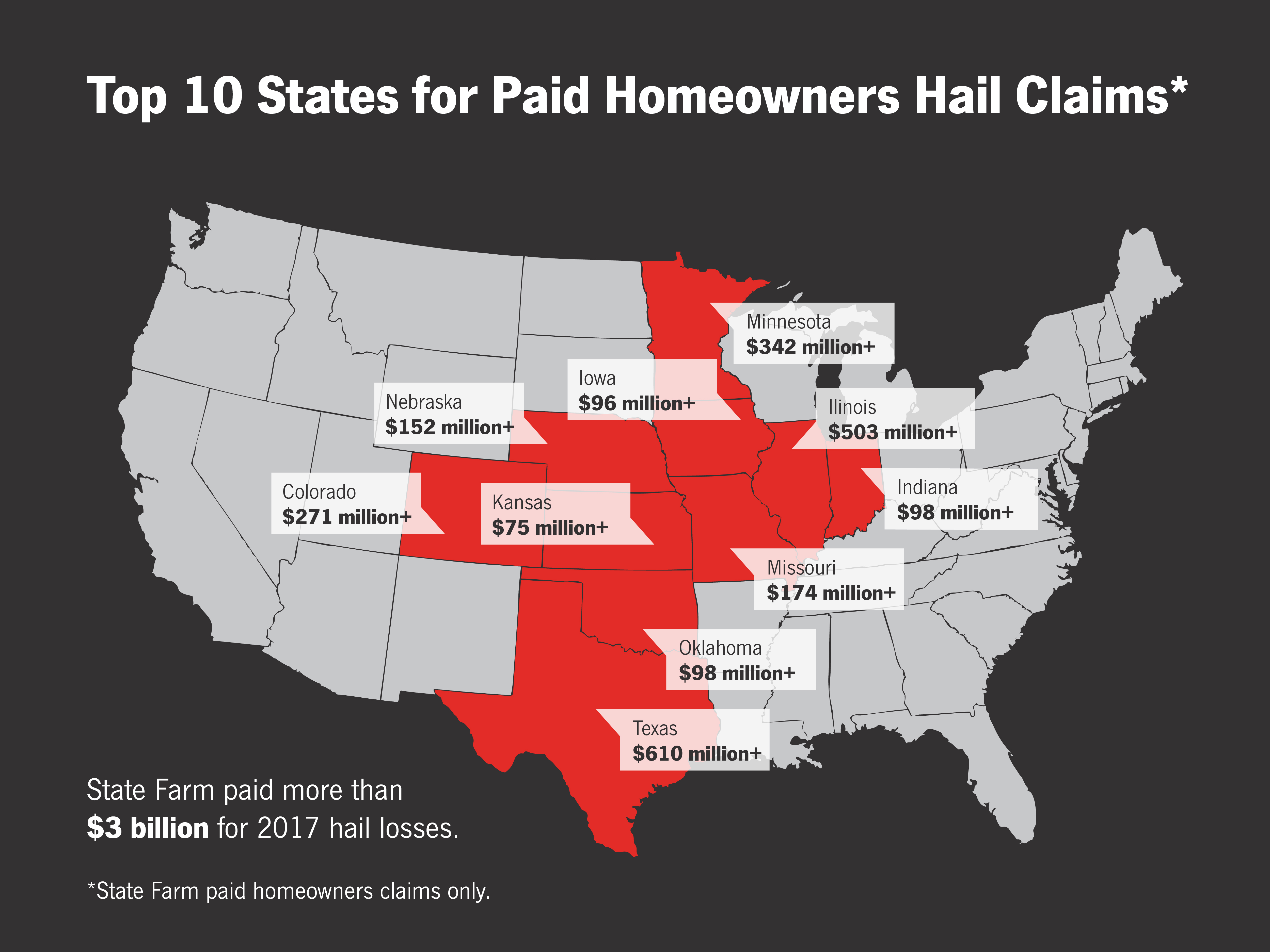

Insurance claims for roofs were a part of that exorbitant figure. In 2012 hail and wind damage cost state farm insurance more than 3 9 billion. Do i have hail damage to my roof. Homeowners insurance typically covers damage caused to your roof by hail windstorms fire tornados and vandalism.

I came across a trial court order which discussed state farm s operation guideline for handling hail and wind damage to composition roofs. If you need to file a claim state farm works with you throughout the insurance claim process. My roof has 65 wind and hail damage and they want to patch it. State farm offers roof and property damage coverage from hailstorms for both home and business owners but how can you tell if it will pay a fair amount for your claim.

I m now requesting a 2nd inspection from state farm. Hail and wind damage claims are the most common types of homeowners claims.